Colorado Proposition GG, Include Income Tax Effects in Initiative Ballot Language Measure (2022)

| Colorado Proposition GG | |

|---|---|

| |

| Election date November 8, 2022 | |

| Topic Direct democracy measures | |

| Status | |

| Type State statute | Origin State legislature |

Colorado Proposition GG, the Table of Changes to Income Tax Owed Required for Citizen Initiatives Measure, was on the ballot in Colorado as a legislatively referred state statute on November 8, 2022. The measure was approved.

A "yes" vote supported requiring the ballot titles and fiscal impact summaries for initiatives that affect income taxes to include information on how the change would affect income taxes for different categories of income. |

A "no" vote opposed this measure to change the requirements for initiative ballot language, thereby leaving in place the existing requirements for ballot initiative fiscal impact statements and not requiring ballot titles to include a table of tax changes. |

Election results

|

Colorado Proposition GG |

||||

|---|---|---|---|---|

| Result | Votes | Percentage | ||

| 1,704,757 | 71.92% | |||

| No | 665,476 | 28.08% | ||

Overview

What did Proposition GG change?

- See also: Background and Measure design

This measure was designed to require ballot titles and fiscal impact summaries for initiatives that increase or decrease the individual income tax rate to include a table showing the potential tax changes for those in different income categories under the proposed initiative. Changes were set to be expressed by a dollar amount and a plus sign (+) if taxes owed would be increased or a negative sign (-) if the taxes owed would be decreased.[1][2]

The Colorado Title Board provides ballot titles (the question that appears on the ballot) for ballot initiatives in Colorado. The Director of Research of the Legislative Council, a nonpartisan service for the Colorado State Legislature, prepares fiscal summaries for ballot initiatives when the initiative is heard by the title board. Once an initiative has been approved for signature gathering, a full fiscal impact statement is prepared, which must be displayed on each section of the petition form during signature gathering. Additionally, the Legislative Council Staff prepares fiscal impact statements for all statewide ballot measures, which are published on the Legislative Council Staff website and summarized in the Colorado Blue Book, the state's voter guide.[3][4]

What were the ballot language requirements for Colorado initiatives as of 2022?

- See also: Background and Fiscal impact summaries

Going into the election, measures increasing or decreasing the income tax rate or the sales tax rate included a table showing the average tax change for taxpayers in 12 specified income categories. As of 2022, fiscal impact statements included the following information:[4][5][6]

- an estimate of the effect the proposed measure would have on state and local government revenues, expenditures, taxes, and fiscal liabilities;

- an estimate of state and local government expenditures or liabilities; and

- an estimate of the impact to the average taxpayer for measures that change state tax laws.

Going into the election, ballot titles for Colorado initiatives did not include a table showing potential tax changes, however, ballot measures that would increase taxes requiring voter approval under the Colorado Taxpayer's Bill of Rights (TABOR) required ballot titles to be printed in capital letters beginning with, "SHALL (DISTRICT) TAXES BE INCREASED (first, or if phased in, final, full fiscal year dollar increase) ANNUALLY...?"

What did supporters and opponents say about Proposition GG?

- See also: Supporters and Opponents

State Sen. Brittany Pettersen (D), a prime sponsor of the bill, said that the measure is "an incredibly important tax transparency measure."[7]

Michael Fields, President of Advance Colorado Institute and sponsor of previous tax-related initiatives in Colorado said, "I hear from a lot of people that our ballot language is already way too long and too complicated. This legislature should spend more time on increasing public safety and lowering the cost of living — and less on meddling in the citizens initiative process."[7]

What campaigns have registered to spend money supporting and opposing Proposition GG?

Coloradans for Ballot Transparency registered as an issue committee to support Proposition GG. The committee reported $1.07 million in contributions. The Sixteen Thirty Fund provided $500,000 to the committee.[8][9]

Coloradans Coming Together also registered to support Proposition GG as well as to oppose Proposition 121. The committee reported $95,841.86 in cash and in-kind contributions.

Path 2 Zero registered to support Propositions 121, 124, 125, 126, and Amendment E; and registered to oppose Propositions 123, GG, FF, and Amendment F. It is impossible to distinguish between funds spent on each individual measure. The committee reported $10,430.70 in in-kind contributions from Independence Institute.[10]

How did Proposition GG get on the ballot?

- See also: Path to the ballot

To put a legislatively referred state statute before voters, a simple majority is required in both the Colorado State Senate and the Colorado House of Representatives. A bill that is referred to the voters does not require the governor's signature and cannot be vetoed.

The bill was introduced as Senate Bill 222. It was approved in the state Senate on May 2, 2022, by a vote of 20-15. On May 11, 2022, the state House approved the measure by a vote of 40-22. The bill passed with all voting Democrats in favor and 95% of Republicans opposed.[1]

Senate Bill 222 sponsors decided to refer it to the voters so that it would not require Gov. Jared Polis' (D) signature. State Rep. Chris Kennedy (D) said, “There are a number of components (last year) where we reached agreement with the governor. But he expressed some concern about the idea of printing a table where it breaks down the value of the tax benefit or the tax increase to different income brackets … on the ballot itself. So, this year, what we’ve introduced is a bill that’s going to refer this question to the voters so that the governor doesn’t have to weigh in on it.” A spokesperson for Governor Polis said he believes that "voters should decide how issues are presented on the people’s ballot because it is their ballot, not the state legislature’s ballot."[7]

Measure design

Proposition GG was designed to require fiscal impact summaries and ballot titles for initiatives that increase or decrease the individual income tax rate to include a table showing the potential tax changes for those in eight specified income categories under the proposed initiative. Under the proposal, changes were set to be expressed by a dollar amount and a plus sign (+) if taxes owed would be increased or a negative sign (-) if the taxes owed would be decreased.[2]

The table was designed to have the following four columns with the following information:[2]

- Income Categories — showing eight different federal adjusted gross income categories:

- $25,000 or less

- $25,000 to $50,000

- $50,000 to $100,000

- $100,000 to $200,000

- $200,000 to $500,000

- $500,000 to $1,000,000

- $1,000,000 to $2,000,000

- $2,000,000 to $5,000,000

- Current Average Income Tax Owed — showing the average income tax owed in each category;

- Proposed Average Income Tax Owed — showing the average income tax that would be owed if the proposed initiative was approved; and

- Proposed Change in Average Income Tax Owed — showing the difference between the average income tax that would be owed if the proposed initiative was approved and if the proposed initiative was rejected.

Proposed table and table used going into the election

Below is an example of the proposed table:[2]

| Income Category | Current Average Income Tax Owed | Proposed Average Income Tax Owed | Proposed Change in Average Income Tax Owed |

|---|---|---|---|

| $25,000 or less | |||

| $25,000 to $50,000 | |||

| $50,000 to $100,000 | |||

| $100,000 to $200,000 | |||

| $200,000 to $500,000 | |||

| $500,000 to $1,000,000 | |||

| $1,000,000 to $2,000,000 | |||

| $2,000,000 to $5,000,000 |

Below is an example of the table used going into the election:[11]

| Income Category | Estimated number of taxpayers | Total Change in Tax Burden | Average Change

in Tax Burden |

|---|---|---|---|

| $14,999 or less | |||

| $15,000 to $29,999 | |||

| $30,000 to $39,999 | |||

| $40,000 to $49,999 | |||

| $50,000 to $69,999 | |||

| $70,000 to $99,999 | |||

| $100,000 to $149,999 | |||

| $150,000 to $199,999 | |||

| $200,000 to $249,999 | |||

| $250,000 to $499,999 | |||

| $500,000 to $999,999 | |||

| $1,000,000 or more |

Text of the measure

Ballot title

The ballot title was as follows:[2]

| “ |

Shall there be a change to the Colorado Revised Statutes requiring that the ballot title and fiscal summary for any ballot initiative that increases or decreases state income tax rates include a table showing the average tax change for tax filers in different income categories? [12] |

” |

Full text

The full text of the measure is below:[2]

Readability score

- See also: Ballot measure readability scores, 2022

Using the Flesch-Kincaid Grade Level (FKGL) and Flesch Reading Ease (FRE) formulas, Ballotpedia scored the readability of the ballot title for this measure. Readability scores are designed to indicate the reading difficulty of text. The Flesch-Kincaid formulas account for the number of words, syllables, and sentences in a text; they do not account for the difficulty of the ideas in the text. The state legislature wrote the ballot language for this measure.

The FKGL for the ballot title is grade level 22, and the FRE is 11. The word count for the ballot title is 45.

Support

Coloradans for Ballot Transparency led the Yes on GG campaign.

Supporters

Officials

- State Sen. Dominick Moreno (D)

- State Sen. Brittany Pettersen (D)

- State Rep. Chris Kennedy (D)

- State Rep. Mike Weissman (D)

Arguments

Official arguments

The following is the argument in support of the measure found in the Colorado Blue Book:[13]

|

Opposition

Opponents

Individuals

- Michael Fields (R) - President of Advance Colorado Institute

Arguments

Official arguments

The following is the argument in opposition to the measure found in the Colorado Blue Book:[14]

|

Media editorials

- See also: 2022 ballot measure media endorsements

Ballotpedia lists the positions of media editorial boards that support or oppose ballot measures. This does not include opinion pieces from individuals or groups that do not represent the official position of a newspaper or media outlet. Ballotpedia includes editorials from newspapers and outlets based on circulation and readership, political coverage within a state, and length of publication. You can share media editorial board endorsements with us at editor@ballotpedia.org.

Support

Opposition

You can share campaign information or arguments, along with source links for this information, at editor@ballotpedia.org

Campaign finance

Coloradans for Ballot Transparency registered as an issue committee to support Proposition GG. The committee reported $1.07 million in contributions. The Sixteen Thirty Fund provided $500,000 to the committee.[8][15]

Coloradans Coming Together also registered to support Proposition GG as well as to oppose Proposition 121. The committee reported $95,841.86 in cash and in-kind contributions.

Path 2 Zero registered to support Propositions 121, 124, 125, 126, and Amendment E; and registered to oppose Propositions 123, GG, FF, and Amendment F. It is impossible to distinguish between funds spent on each individual measure. The committee reported $10,430.70 in in-kind contributions from Independence Institute.[16]

| Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures | |

|---|---|---|---|---|---|

| Support | $1,067,053.13 | $96,017.66 | $1,163,070.79 | $1,059,259.63 | $1,155,277.29 |

| Oppose | $0.00 | $10,430.70 | $10,430.70 | $0.00 | $10,430.70 |

Support

The following table includes contribution and expenditure totals for the committee(s) in support of the measure.[8]

| Committees in support of Proposition GG | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| Coloradans for Ballot Transparency | $1,057,052.13 | $10,176.80 | $1,067,228.93 | $1,057,052.13 | $1,067,228.93 |

| Coloradans Coming Together | $10,001.00 | $85,840.86 | $95,841.86 | $2,207.50 | $88,048.36 |

| Total | $1,067,053.13 | $96,017.66 | $1,163,070.79 | $1,059,259.63 | $1,155,277.29 |

Donors

The following were the top donors who contributed to the support committee.[8]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| Sixteen Thirty Fund | $500,000.00 | $0.00 | $500,000.00 |

| National Education Association | $250,000.00 | $0.00 | $250,000.00 |

| Colorado Fund for Children & Public Education | $100,000.00 | $0.00 | $100,000.00 |

| Merle Chambers | $100,000.00 | $0.00 | $100,000.00 |

| United for a New Economy | $65,000.00 | $0.00 | $65,000.00 |

Opposition

The following table includes contribution and expenditure totals for the committee in opposition to Proposition GG. Path 2 Zero also registered to support Proposition 121, the income tax reduction initiative. It is not possible to distinguish between funds spent on each individual measure.[8]

| Committees in opposition to Proposition GG | |||||

|---|---|---|---|---|---|

| Committee | Cash Contributions | In-Kind Contributions | Total Contributions | Cash Expenditures | Total Expenditures |

| Path 2 Zero | $0.00 | $10,430.70 | $10,430.70 | $0.00 | $10,430.70 |

| Total | $0.00 | $10,430.70 | $10,430.70 | $0.00 | $10,430.70 |

Donors

The following were the top donors to Path 2 Zero:[8]

| Donor | Cash Contributions | In-Kind Contributions | Total Contributions |

|---|---|---|---|

| Independence Institute | $0.00 | $8,923.96 | $8,923.96 |

Methodology

To read Ballotpedia's methodology for covering ballot measure campaign finance information, click here.

Background

Ballot language in Colorado

Ballot title

Ballot initiatives in Colorado are given ballot titles (the question that appears on the ballot) set by the Colorado Title Board. Ballot language is finalized after proponents submit the original text of the measure to the directors of the legislative council staff and the office of legal services for review and comment. Once the proposed measure has been reviewed, the original, amended and final drafts must be filed with the Colorado Secretary of State. The secretary must then convene the Title Board, which includes the secretary of state, the Colorado Attorney General, and the director of the Office of Legislative Legal Services or the director's designee. At a public meeting, the board selects a title for the measure by majority vote. The title must be phrased in the form of a "yes" or "no" question. The board may also reject a measure if it fails to comply with the state's single-subject rule. If the proponents or any registered voter are unsatisfied with the title board's chosen title or single-subject ruling, a motion for a rehearing may be filed. If objections remain after the rehearing, the proponents or any registered voter may file an appeal with the Colorado Supreme Court.[5]

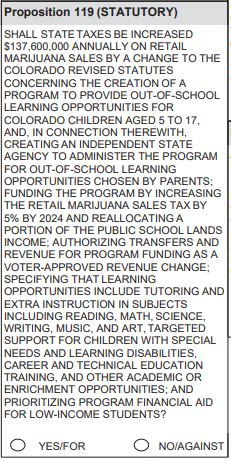

As of 2022, ballot titles for Colorado initiatives did not include a table showing potential tax changes, however, ballot measures that would increase taxes requiring voter approval under the Colorado Taxpayer's Bill of Rights (TABOR) require ballot titles to be printed in capital letters beginning with, "SHALL (DISTRICT) TAXES BE INCREASED (first, or if phased in, final, full fiscal year dollar increase) ANNUALLY...?"

The following image shows the ballot title for a 2021 initiative to increase the marijuana sales tax:[17]

Fiscal impact summaries and statements

The Director of Research of the Legislative Council, a nonpartisan service for the Colorado State Legislature, prepares fiscal summaries for ballot initiatives when the initiative is heard by the title board. Once an initiative has been approved for signature gathering, a full fiscal impact statement is prepared, which must be displayed on each section of the petition form during signature gathering. Additionally, the Legislative Council Staff prepares fiscal impact statements for all statewide ballot measures, which are published on the Legislative Council Staff website and summarized in the Colorado Blue Book, the state's voter guide, detailing any effect a measure will have on revenue, expenditures, taxes, and liabilities.[5]

A bill passed in 2021—House Bill 1321—was designed to require specific language, including a list of services that could be affected, to be used for the ballot summaries and fiscal impact statements of ballot initiatives increasing or reducing tax revenue. The bill required measures increasing or decreasing the income tax rate or the sales tax rate to include a table showing the average tax change for taxpayers in 12 specified income categories. As of 2022, fiscal impact statements included the following information:[4][5][6]

- an estimate of the effect the proposed measure would have on state and local government revenues, expenditures, taxes, and fiscal liabilities;

- an estimate of state and local government expenditures or liabilities; and

- an estimate of the impact to the average taxpayer for measures that change state tax laws.

The following image shows a table of tax changes used in the 2021 Colorado Blue Book that was prepared for a proposed initiative to increase the marijuana sales tax:[18]

Colorado legislatively referred state statutes, 2000-2021

A total of 13 legislatively referred state statutes appeared on the statewide ballot in Colorado between 2000 and 2021. Of the 13 measures, eight appeared on the ballot during even-numbered years and five appeared on the ballot during odd-numbered years. Of the 13 measures, eight were approved and five were defeated.

- Even years: four approved (50%) and four defeated (50%)

- Odd years: four approved (80%) and one defeated (20%)

| Colorado legislatively referred state statutes, 2000-2021 (all years) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Years | Total number | Approved | Percent approved | Defeated | Percent defeated | Annual average | Annual median | Annual minimum | Annual maximum |

| 2000-2021 | 13 | 8 | 61.54% | 5 | 38.46% | <1 | 0 | 0 | 4 |

Path to the ballot

To put a legislatively referred state statute before voters, a simple majority is required in both the Colorado State Senate and the Colorado House of Representatives. A bill that is referred to the voters does not require the governor's signature and cannot be vetoed.

On May 2, 2022, the state Senate approved Senate Bill 222 proposing this measure by a vote of 20-15. On May 11, 2022, the state House approved the measure by a vote of 40-22. The bill passed with all voting Democrats in favor and 95% of Republicans opposed.[1]

Senate Bill 222 sponsors decided to refer it to the voters so that it would not require Gov. Jared Polis' (D) signature. State Rep. Chris Kennedy (D) said, “There are a number of components (last year) where we reached agreement with the governor. But he expressed some concern about the idea of printing a table where it breaks down the value of the tax benefit or the tax increase to different income brackets … on the ballot itself. So, this year, what we’ve introduced is a bill that’s going to refer this question to the voters so that the governor doesn’t have to weigh in on it.”[19]

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

How to cast a vote

- See also: Voting in Colorado

Click "Show" to learn more about voter registration, identification requirements, and poll times in Colorado.

| How to cast a vote in Colorado | |||||

|---|---|---|---|---|---|

Poll timesIn Colorado, polls are open from 7:00 a.m. to 7:00 p.m. local time for those who choose to vote in person rather than by mail. An individual who is in line at the time polls close must be allowed to vote.[20][21] Registration

In Colorado, an individual can register to vote if he or she is at least 16 years old and will be 18 by Election Day. A voter must be a citizen of the United States who has lived in Colorado at least 22 days prior to Election Day.[22] Colorado voters can register to vote through Election Day. However, in order to automatically receive a mail-in ballot, a voter must register at least eight days prior to Election Day. A voter can register online or submit a form in person or by fax, email, or mail.[22][23] Automatic registrationColorado automatically registers eligible individuals to vote through the Department of Motor Vehicles. Online registration

Colorado has implemented an online voter registration system. Residents can register to vote by visiting this website. Same-day registrationColorado allows same-day voter registration for individuals who vote in person. Residency requirementsColorado law requires 22 days of residency in the state before a person may vote. Verification of citizenshipColorado does not require proof of citizenship for voter registration. Verifying your registrationThe site Go Vote Colorado, run by the Colorado Secretary of State office, allows residents to check their voter registration status online. Voter ID requirementsColorado requires voters to present non-photo identification when voting in person. If voting by mail for the first, a voter may also need to return a photocopy of his or her identification with his or her mail-in ballot. Click here for more information. The following list of accepted forms of identification was current as of April 2023. Click here for the most current information, sourced directly from the Office of the Colorado Secretary of State.

| |||||

See also

External links

Footnotes

- ↑ 1.0 1.1 1.2 Colorado State Legislature, "Senate Bill 222," accessed May 12, 2022

- ↑ 2.0 2.1 2.2 2.3 2.4 2.5 Colorado Legislature, "Senate Bill 222," accessed June 3, 2022

- ↑ Colorado State Legislature, "Fiscal summary for Senate Bill 22-222," accessed July 6, 2022

- ↑ 4.0 4.1 4.2 Colorado State Legislature, "Fiscal Impact Statements," accessed July 6, 2022

- ↑ 5.0 5.1 5.2 5.3 Colorado Secretary of State, "Initiatives & Title Board," accessed June 8, 2022

- ↑ 6.0 6.1 [https://leg.colorado.gov/bills/hb21-1321 Colorado General Assembly, "House Bill 1321 (2021)

- ↑ 7.0 7.1 7.2 Colorado Sun, "Democrats avoid Jared Polis in quest to ensure Coloradans get the full picture on income tax changes," accessed June 3, 2022

- ↑ 8.0 8.1 8.2 8.3 8.4 8.5 Colorado TRACER, "COLORADANS FOR BALLOT TRANSPARENCY," accessed September 6, 2022

- ↑ Merles Chambers Fund, "Equity and Democracy," accessed July 6, 2022

- ↑ Colorado TRACER, "Path 2 Zero," accessed November 1, 2022

- ↑ Colorado State Legislature, "2021 Blue Book," accessed July 6, 2022

- ↑ 12.0 12.1 Note: This text is quoted verbatim from the original source. Any inconsistencies are attributable to the original source.

- ↑ Colorado Secretary of State, "Official Voter Information Guide," accessed October 28, 2022

- ↑ Colorado Secretary of State, "Official Voter Information Guide," accessed October 28, 2022

- ↑ Merles Chambers Fund, "Equity and Democracy," accessed July 6, 2022

- ↑ Colorado TRACER, "Path 2 Zero," accessed November 1, 2022

- ↑ Colorado State Legislature, "2021 Blue Book," accessed July 6, 2022

- ↑ Colorado State Legislature, "2021 Blue Book," accessed July 6, 2022

- ↑ Colorado Sun, "Democrats avoid Jared Polis in quest to ensure Coloradans get the full picture on income tax changes," accessed May 2, 2022

- ↑ Colorado Secretary of State, "Mail-in Ballots FAQs," accessed April 11, 2023

- ↑ Colorado Revised Statutes, "1-7-101," accessed April 11, 2023

- ↑ 22.0 22.1 Colorado Secretary of State, "Voter Registration FAQs," accessed April 11, 2023

- ↑ Colorado Secretary of State, "Go Vote Colorado," accessed April 11, 2023

- ↑ Colorado Secretary of State, "Acceptable Forms of Identification," accessed April 11, 2023

|

State of Colorado Denver (capital) |

|---|---|

| Elections |

What's on my ballot? | Elections in 2024 | How to vote | How to run for office | Ballot measures |

| Government |

Who represents me? | U.S. President | U.S. Congress | Federal courts | State executives | State legislature | State and local courts | Counties | Cities | School districts | Public policy |